Introduction

As a student living in Germany, having a credit card can provide financial flexibility and convenience. In Germany, there are many different types of credit cards available from various banks and financial institutions. However, finding the right credit card as a student can be a daunting task, with so many options to choose from.

With this in mind, this blog post aims to provide a comprehensive guide to student credit cards in Germany. We’ll start by explaining what a student credit card is and why it’s important to find the right one. Then, we’ll provide an overview of the credit card market in Germany, including the eligibility requirements and challenges that students may face when applying for credit cards. Finally, we’ll highlight some of the top student credit cards available in Germany, as well as tips for improving your chances of getting approved. By the end of this post, you should have a better understanding of how to choose the best credit card for your needs as a student in Germany.

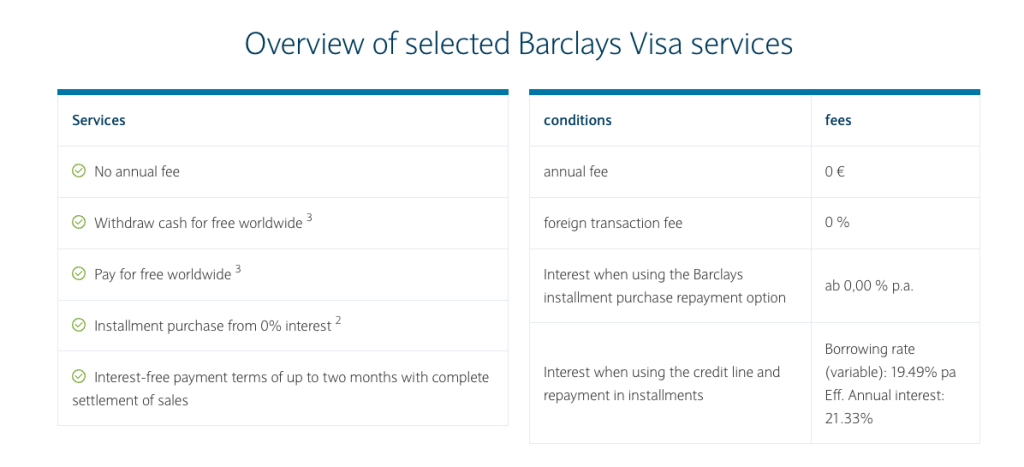

The Barclays Visa Credit Card

The Barclay card Visa credit card is a highly popular option among students and anyone looking for a free credit card in Germany. This card offers several features that make it an attractive choice for those who want a simple and convenient credit card that won’t cost them a lot in fees.

Convenience

One of the standout features of the Barclay card Visa is the fact that there are no additional charges for international payments and withdrawals. This makes it a great choice for students who may be studying abroad or traveling frequently. With this card, you can make purchases and withdraw money anywhere in the world without worrying about incurring extra fees.

Apple Pay & Google Pay

Another appealing feature of the Barclay card Visa is the ability to use Apple Pay and Google Pay. This allows you to make quick and easy payments using your phone or other compatible device, making it a convenient choice for those who are always on the go.

Interest Rates

The Barclay card Visa also offers payment plans for qualifying purchases starting at 0% interest. This means that you can spread the cost of larger purchases over time without having to worry about paying interest on top of the purchase price. This can be a great benefit for students who may need to make larger purchases but want to avoid high interest charges.

Partner Card

Additionally, the Barclay card Visa comes with a free partner card, which can be a great way to share the benefits of the card with a family member or significant other. You can also choose to pay your bill in full or in part at the end of the month via SEPA, which offers flexibility in managing your finances.

Overall, the Barclay card Visa credit card offers a range of features that make it a highly attractive option for students and anyone looking for a free and convenient credit card in Germany. Whether you are looking to make international payments, spread the cost of larger purchases, or simply enjoy the benefits of a credit card without incurring high fees, the Barclay card Visa is definitely worth considering.

Amex Payback Card

For students in Germany who are looking for a credit card that can offer them extra benefits and rewards, the Payback American Express card could be a great option to consider. The Payback program is a popular loyalty program in Germany that allows customers to earn bonus points when they shop at selected stores. The Payback American Express card is one of the easiest ways to earn these bonus points, as it offers cardholders a point for every euro they spend.

Free to use

One of the best things about the Payback American Express card is that it is free to use. This means that students can enjoy the benefits of the Payback program without having to pay any extra fees or charges. In addition to earning points, the Payback American Express card also allows cardholders to redeem their points for various rewards. This could include shopping vouchers, travel rewards, or even cash back.

Payback Points

What many people may not realize is that they can also have their Payback points paid out to them directly. This means that if a student has accrued a significant number of points, they can choose to have them paid out as cash, which could be a helpful way to supplement their budget. Alternatively, they can also convert their Payback points into miles for select airline partners.

In terms of rewards, the average person can earn up to 100 euros back at the end of the year with the Payback American Express card. This can be a helpful way for students to offset some of their expenses while enjoying the benefits of a credit card.

Overall, the Payback American Express card could be an excellent choice for students who are looking for a free credit card that offers rewards and benefits. By using the card to make everyday purchases and taking advantage of the Payback program, students can earn extra points that can be redeemed for a variety of rewards.

What To Consider When Choosing a Credit Card As a Student

When it comes to choosing a credit card as a student, there are several factors that should be taken into consideration. These include the interest rate, fees, and rewards programs. Here are some points to keep in mind:

- Interest Rate: The APR or interest rate of a credit card can have a significant impact on your finances. This rate determines how much interest you will accrue on your balance if you do not pay it off in full each month. As a student, it is important to choose a credit card with a low interest rate to avoid accumulating high levels of debt.

- Fees: In addition to the interest rate, credit cards can also come with various fees, such as annual fees and foreign transaction fees. It is important to compare these fees across different credit card options and pick a card with minimal fees. This can help you save money in the long run and avoid unnecessary expenses.

- Rewards Programs: Credit cards often come with rewards programs that allow you to earn cashback or points on purchases. These rewards can be a great way to offset the cost of using the card. However, it is essential to select a rewards program that aligns with your spending habits and financial goals. For example, if you frequently shop at certain stores, look for a credit card that offers rewards for those purchases.

Overall, choosing the right credit card as a student requires careful consideration of these factors. It is important to compare different options and decide on a card that fits your financial situation and goals.

It is also important to consider your credit score when choosing a credit card. As a student, you may not have a long credit history, which can make it difficult to be approved for certain credit cards. You should request for your free Schufa report every year here to see how you are doing with your credit rating.

How To Use Credit Cards Responsibly As a Student

When using a credit card, it is essential to use it responsibly to avoid accruing unnecessary debt. This means paying off the balance in full each month to avoid interest charges and monitoring your spending to ensure that you stay within your budget. It is also critical to avoid using a credit card to finance purchases that you cannot afford to pay off in full, as this can lead to accumulating debt and damaging your credit score.

If you would like to finance your purchases in Germany, you will find a lot of 0% financing with the major retailers. Opt for these than putting it on a credit card. Interests can balloon quite quickly.

Conclusion

In conclusion, finding the right credit card as a student in Germany can be a challenging but worthwhile task. By comparing different options and considering factors such as eligibility requirements, fees, and rewards programs, students can find a credit card that best suits their needs. Additionally, foreign students can improve their chances of getting approved by having a good credit score and providing all necessary documentation. We hope this guide has been helpful in navigating the world of student credit cards in Germany. If you have any questions or experiences to share, we encourage you to leave a comment below.

Frequently Asked Questions

While students in Germany can apply for credit cards, there are certain eligibility requirements that must be met. These include having a regular income, being over 18 years of age, and having a good credit score. For students who don’t have a regular income, a parent or guardian may need to act as a co-signer on the credit card application.

Qualifying for a credit card as a student in Germany can be challenging, particularly if you don’t have a long credit history. However, there are steps you can take to improve your chances of getting approved, such as building up a good credit score and choosing a credit card with lower eligibility requirements.

There are several banks in Germany that offer credit cards specifically for students. Some of the most popular options include Deutsche Bank, Sparkasse, and Commerzbank. Each bank has its own set of features and benefits, as well as eligibility requirements.

When choosing a student credit card, it’s important to compare the different options and find one that best suits your needs. Some of the factors to consider include the annual fee, interest rates, credit limit, and rewards program. It’s also worth considering which banks are most popular among students, as this can be a good indication of the quality of their credit card offerings. In the next section, we’ll take a closer look at some of the top student credit cards available in Germany.

Foreign students living in Germany can apply for credit cards, but they may face additional challenges in getting approved. Eligibility requirements typically include having a valid residence permit, a German bank account, and a regular income. Foreign students may also face language barriers and difficulty in establishing a credit history in Germany.

To improve your chances of getting approved for a credit card as a foreign student, it’s important to have a good credit score and provide all necessary documentation. It’s also worth considering credit cards from banks that are known to be more friendly to foreign students.

Start the discussion at community.ichberlin.com